Case in point: Does the price paid at a trustee's foreclosure sale establish a property's fair market value (FMV)?

Capital Gain Tax on Sale of Inherited Property|How to Calculate FMV of Property as on 2001|Taxpundit - YouTube

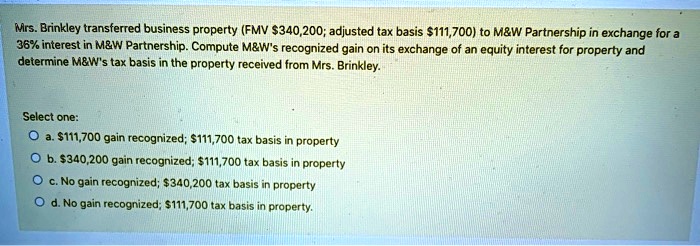

SOLVED: Mrs; Brinkley transferred business property (FMV 5340,200; adjusted tax basis S111,700) to MeW Partnership in exchange for a 36* interest in MEW Partnership. Compute Mews recognized gain on its exchange of

:max_bytes(150000):strip_icc()/GettyImages-1282129536-beafb31e37e74462b48ac232502a7383.jpg)