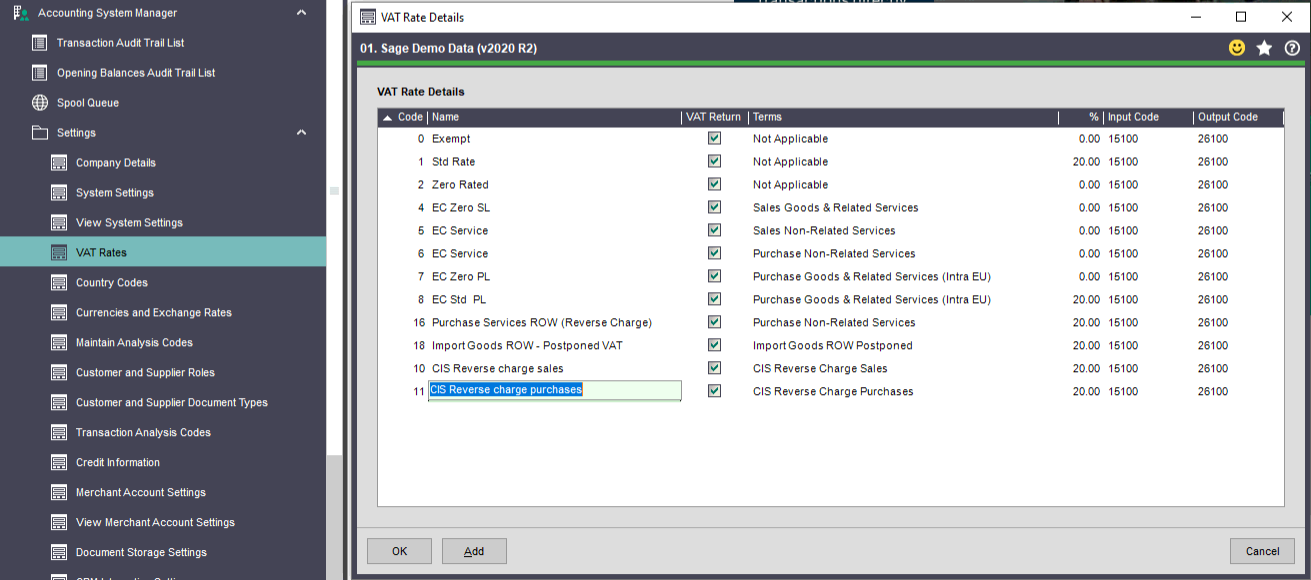

How to configure VAT codes for Construction Reverse Charge VAT if using Version 26 or Version 27 of Sage 50 Cloud Accounts

How to configure VAT codes in Sage 50 Accounts for Construction Reverse Charge VAT (Version 25 or earlier)

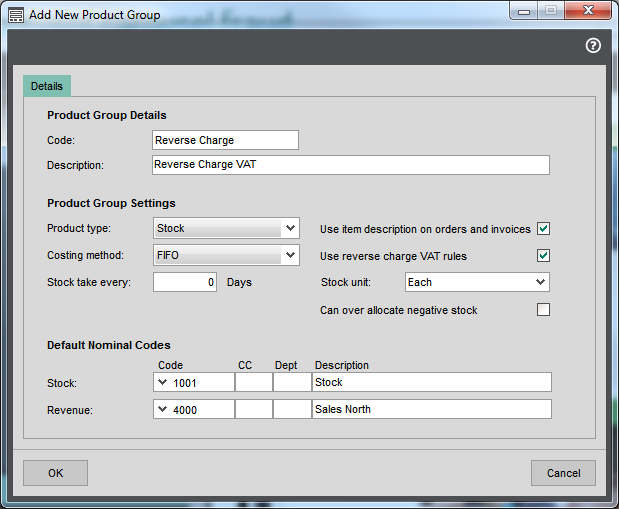

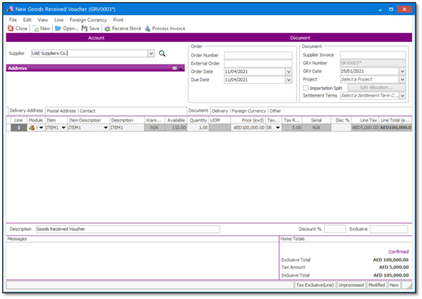

Understanding Reverse Charges in Sage 200 Evolution - Sage 200 Evolution Support Insights - Sage 200 Evolution - Sage City Community

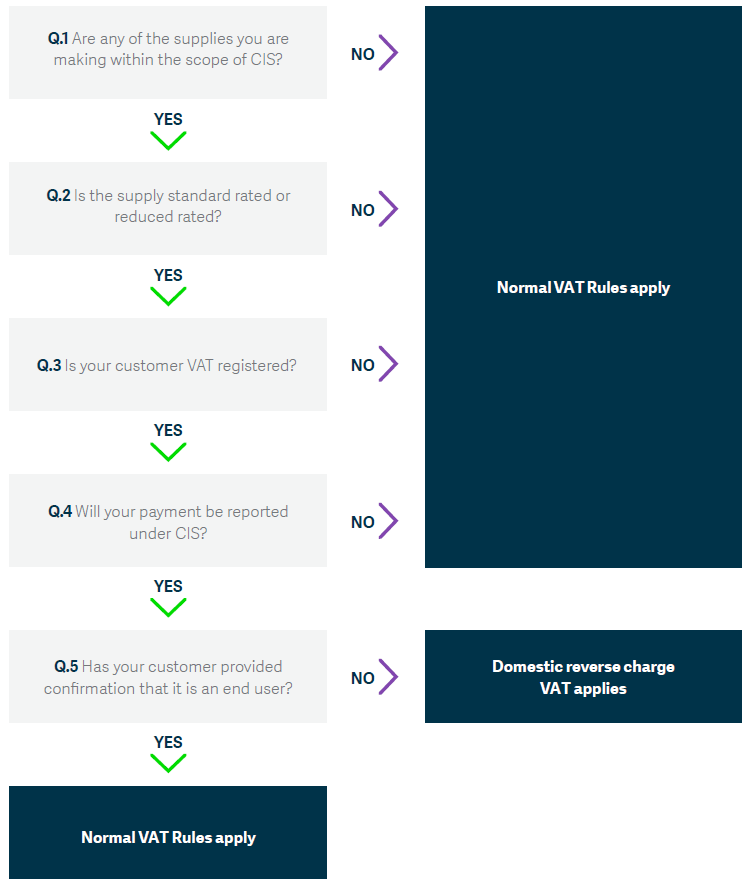

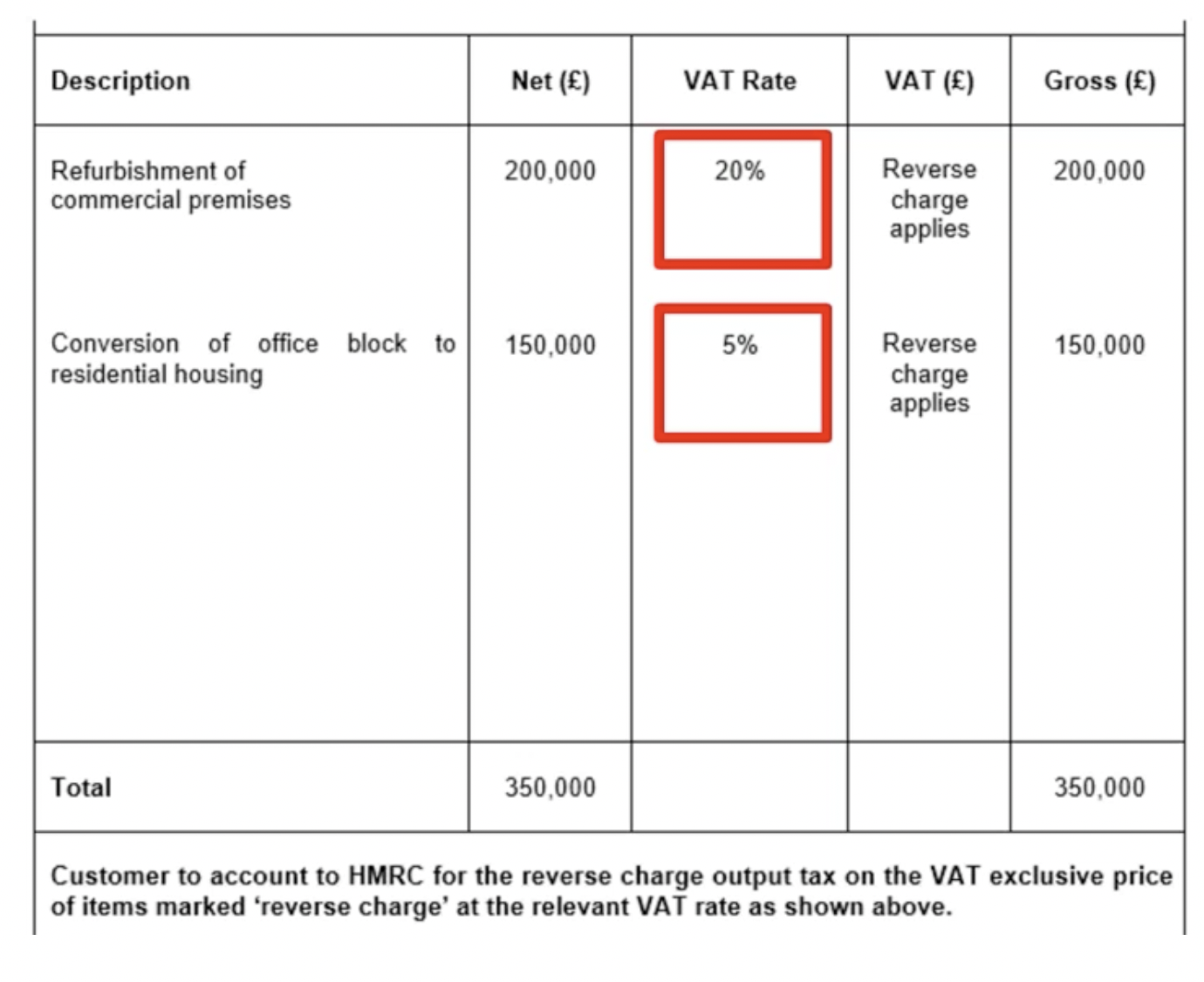

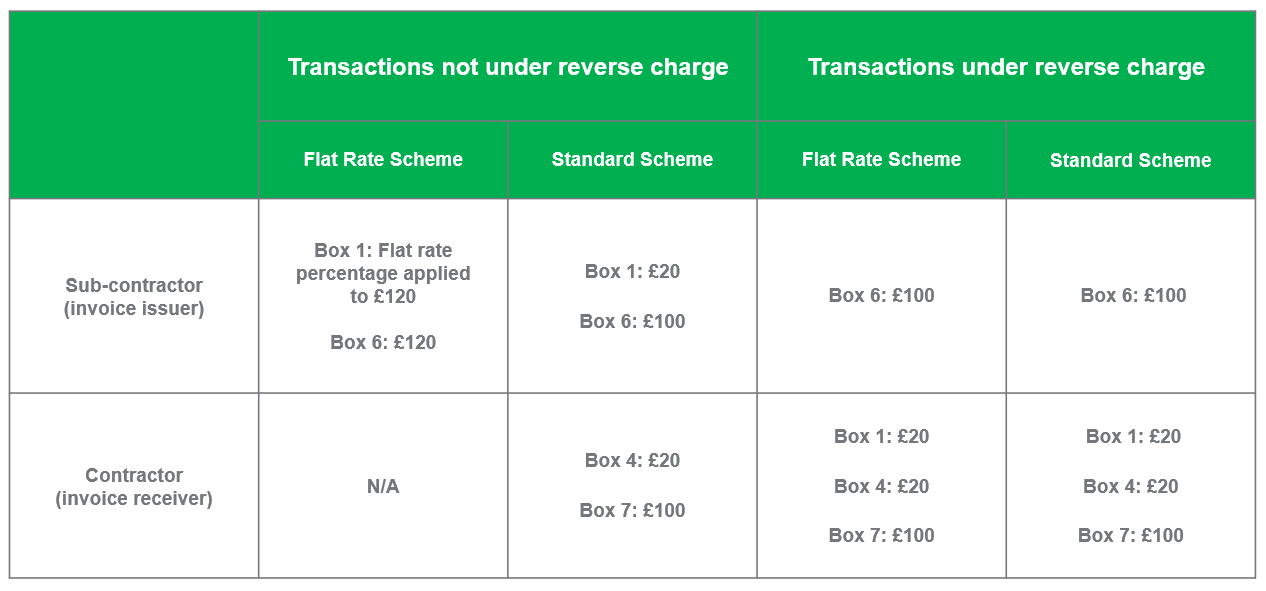

VAT domestic reverse charge for construction: 23 things you need to know - Sage Advice United Kingdom